The myth of going for broke

The goal of every major league organization (at least I hope) is to win the World Series. Each team has its own plan and path for getting there, but in the end they’re all striving for the same result.

There are times when teams build new stadiums or sign new TV deals and use these cash inflows to invest in premium talent that could put their organization over the top. Some teams develop a deep farm system for years, investing in young talent that they hope to some day cash in on. Other teams get a taste at success by reaching the playoffs or coming close and spend big the next offseason in hopes of reaching that next step.

This new investment in talent or increase in spending is commonly referred to as “going for broke.”

Before the 2012 season, the Miami Marlins supposedly cashed in on their new stadium and became one of the biggest spenders of that offseason.

They signed major free agents Jose Reyes, Mark Buehrle and Heath Bell.

The Marlins organization believed it had a shot at taking NL East supremacy and increased its payroll from $57.7 million in 2011 to $101.6 million in 2012, an incredible 76 percent increase.

Unfortunately for Miami, adding a wealth of talent to an already established core did not lead to success. In 2012, the Marlins won three fewer games than in 2011 (72 wins in 2011).

The Marlins aren’t the only team in recent memory who “went for broke” and came out worse in the next season.

The 2008 Detroit Tigers may be the most famous case. They increased their payroll from $98 million in 2007 to $138 million (40.8 percent increase). Detroit traded a slew of prospects for Dontrelle Willis and Miguel Cabrera, and then signed both to big extensions. They also traded prospects for Edgar Renteria, signed Carlos Guillen to an extension and re-signed free agent pitchers Todd Jones and Kenny Rogers.

Everyone expected big things from the Tigers in 2008, but their big additions did not lead to a World Series championship. Instead the Tigers won just 74 games, 14 fewer than they won 2007.

This offseason it seems that both the Kansas City Royals and Toronto Blue Jays are going for it in 2013. Both teams have cashed in their farm systems to acquire quality major league talent that they hope will put them over the top and into the playoffs.

Toronto hasn’t made the playoffs since 1993, and it’s been even longer for Kansas City, which hasn’t been to the postseason since 1985. Both teams have increased their payrolls from last season (the Blue Jays substantially) and hope their big offseason moves will end these long playoff droughts.

When a team goes for it and uses extra revenue or prospects to attempt to win now, fans of the team and writers become excited about the upcoming season. The 2012 Marlins and 2008 Tigers are cautionary tales, though, that success may not be as automatic as one would expect. A lot of baseball teams look great on paper, but the games aren’t played on paper, or on spreadsheets for that matter.

I decided to test whether a significant increase in payroll actually leads to success or if it doesn’t mean much at all.

The study

I looked at each team since 2002 whose overall payroll has jumped up by at least 20 percent during the offseason (payrolls have been increasing across baseball at a fairly steady rate of about four percent over this time).

There have been 79 teams with payroll increases that qualified for this sample, and I looked at each team’s change in win total from the previous season to see whether the payroll increase would coincide with an increase in wins. On average, the teams in the sample saw a change of -0.96 wins in the season in which they increased payroll. That’s right, not only did these teams not improve, they actually, on average, lost one more game than in the previous season.

I wouldn’t consider this result as evidence that a payroll increase actually made these teams worse, but instead that the effect was negligible. However, just because there was no real effect overall does not mean some teams did not improve. I looked at which teams improved the most after their increase in payroll, as well as those teams that performed much worse than in the previous season.

Top five win improvements

| Team | Payroll X+1 | Payroll X | Change in payroll | % Change | Change wins | Wins X+1 | Wins X |

|---|---|---|---|---|---|---|---|

| 2008 Tampa Bay Rays | $47,124,500 | $25,790,800 | $21,333,700 | 82.70% | 31 | 97 | 66 |

| 2002 Anaheim Angels | $61,414,167 | $46,945,167 | $14,469,000 | 30.80% | 24 | 99 | 75 |

| 2006 Detroit Tigers | $85,198,456 | $67,868,500 | $17,329,956 | 25.50% | 24 | 95 | 71 |

| 2004 San Diego Padres | $59,172,333 | $43,565,000 | $15,607,333 | 35.80% | 23 | 87 | 64 |

| 2012 Washington Nationals | $94,568,929 | $70,794,429 | $23,774,500 | 33.60% | 18 | 98 | 80 |

The 2012 Nationals and 2008 Rays had suffered through numerous losing seasons while they built from within before they both picked their spot and went for it in 2012 and 2008, respectively. After signing Jayson Werth the year before, the Nationals added Edwin Jackson and Gio Gonzalez, called up Bryce Harper and welcomed Stephen Strasburg back from injury. They went on to win the NL East.

For Tampa Bay, many young stars were coming into their prime and thus received raises through arbitration, which lifted the payroll. The Rays also may have realized how talented their core was as they added veteran free agents Cliff Floyd and Troy Percival to a team that would win the AL pennant.

The 2002 Anaheim Angels also had a slew of arbitration raises, but they also traded for Brad Fullmer and signed free agent Aaron Sele on their way to a World Series championship.

The 2006 Detroit Tigers were the AL Champions after their major payroll increase from 2005. Star outfielder Magglio Ordonez got a big raise, Kenny Rogers was their main free agent signing, and many other core players were given raises.

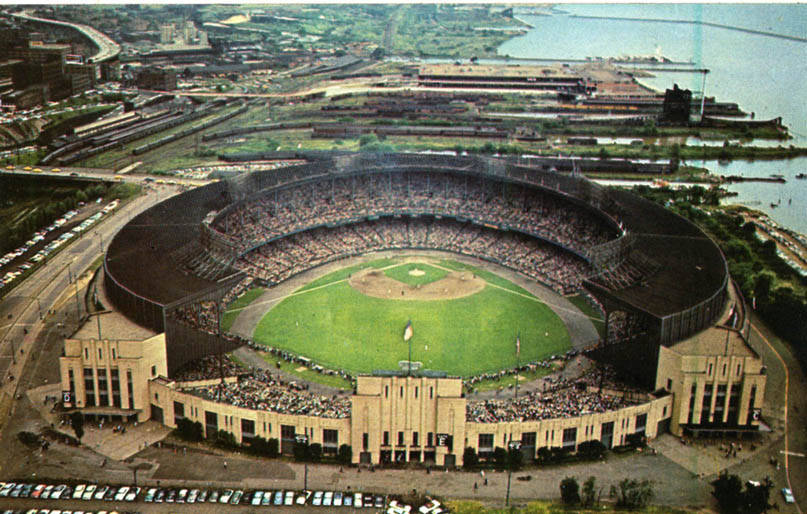

The 2004 San Diego Padres moved into brand-new Petco Park, won 23 more games than they had in the previous season, and reached the playoffs. Their payroll had risen from the season before (possibly because of their new digs) through the additions of Brian Giles (late in the ’03 season), Ramon Hernandez, Terrence Long, David Wells and Jeff Cirillo.

Top five drops in win totals

| Team | Payroll X+1 | Payroll X | Change in payroll | % Change | Delta wins | Wins X+1 | Wins X |

|---|---|---|---|---|---|---|---|

| 2008 San Diego Padres | $74,010,117 | $58,571,067 | $15,439,050 | 26.40% | -26 | 63 | 89 |

| 2003 Anaheim Angels | $77,001,667 | $61,414,167 | $15,587,500 | 25.40% | -22 | 77 | 99 |

| 2011 San Diego Padres | $45,869,140 | $37,799,300 | $8,069,840 | 21.30% | -19 | 71 | 90 |

| 2007 Oakland Athletics | $80,777,050 | $64,615,625 | $16,161,425 | 25.00% | -17 | 76 | 93 |

| 2008 Colorado Rockies | $70,706,500 | $57,062,000 | $13,644,500 | 23.90% | -16 | 74 | 90 |

The 2008 and 2011 Padres have similar stories. Both teams were coming off successful seasons and wanted to build off that in the next season. The ’08 Padres brought back Greg Maddux, signed free agent Randy Wolf and traded for Jim Edmonds but failed to duplicate their success. The ’11 Padres kept much of their roster intact from the previous season, with many of their key players becoming more expensive through arbitration, but like the ’08 Padres, they incurred a serious drop in wins.

The 2003 Angels were coming off a World Series victory and, like the ’11 Padres, thought that keeping the same (more expensive) roster together would be result in more success, but injuries and regression to the mean kept that from happening.

The 2007 Oakland A’s are an interesting case. Despite playoff success in 2006, many would have expected Billy Beane to trade his costly veterans—Jason Kendall, Eric Chavez and Esteban Loaiza—exchange for cheaper prospects in hopes of keeping the payroll low while constantly restocking the team with talent.

Instead, Beane chose to keep his veterans and signed another veteran free agent, Mike Piazza, to a big contract. The one time that Beane decided to hold his cards did not work out: Oakland won 17 fewer games than in the previous season.

The 2008 Rockies were coming off their first World Series appearance, and like the other teams on this list, wanted to build off this appearance with added revenues and a more confident ownership. They signed star outfielder Matt Holliday to an extension, brought in free agent reliever Luiz Vizcaino, and a large portion of the rest of their core received raises, but Colorado regressed a great deal, winning only 74 games in 2008.

I thought that looking at the sample as a whole and simply looking at teams that improved or regressed was not enough, so I considered a few other factors.

For one, an increase of 20 percent in payroll is a bigger jump for a team in a big market that already had a large payroll than for a small market team that began with a low payroll. Also, if a team was coming off a successful playoff season, the ownership’s taste of some success, as well as possible added revenues, could cause a team to increase payroll in hopes of continuing that success in the subsequent season.

Small market vs. big market

I had trouble deciding whether small market teams that increase payroll should expect more success in the next season, given the number of reasons why they might decide to increase. The most obvious reason would be young players beginning to receive arbitration raises.

Small market teams tend to have low payrolls and the majority of their players have less than three years of major league service and thus are eligible to make the league minimum salary. As these players accrue more service time, if the team elects not to trade them, its payroll will inevitably rise.

It’s difficult to say what effect this would have their team’s overall performance. Typically, arbitration years coincide with a player’s prime; thus, you’d expect that if a small market team has a bunch of players moving into their arbitration seasons at the same time (large increase in overall payroll, you’d see an improvement in overall team performance. However, every player does not age the same; thus, you can’t assume that prime years will always coincide with a player’s prime.

Small market teams also increase payroll when their front office believes their young core is good enough that the addition of one or two free agents or veterans through trade will be enough to put their team over the top; again, the effect on overall success of this type of thinking is uncertain.

So I controlled for small market teams to see whether their payroll increases tended to lead to more wins, as compared to the rest of the sample. I defined small market as a team with a payroll that was below 75 percent of the major league median payroll in the year before it increased spending.

Of the 79 teams that increased payroll by 20 percent from 2002-12, 47 had a payroll below 75 percent of the median in the year before the increase. On average these teams lost 1.7 more games in the season after the increase.

It seems that whatever the cause of the increase is (free agents, trades or arbitration raises), on average, small market teams do not win more in the year of the increase.

For teams in big (or above average) markets a 20 percent increase in payroll is much larger nominal increase. The ways in which payroll could increase for teams with higher payrolls are the same as small market teams: free agency, trades and arbitration raises.

The assumption, by most, would be that typically for teams that already have a high payroll, major increases would come from free agent contracts rather than arbitration raises.

If that assumption were in fact true (it’s obviously true some of the time, but is not always the reason for an increase) do free agents make a team much better the next season?

I apologize for sounding like a broken record, but the average increase in wins was -0.26 (essentially negligible) for the 23 teams that had a higher than median payroll in the year before they increased payroll by 20 percent or more.

Playoff teams

My final idea for why an organization would want to increase payroll significantly would be to maintain or build off success in the previous season.

Sometimes, a team uses added revenues from reaching the postseason or winning the World Series to invest in more expensive talent, or a team comes so close to reaching the postseason that its ownership can taste success and is willing to expand the budget for the next season.

Of the 79 teams in my sample, 28 won at least 88 games in the season before they increased payroll. My hypothesis would be that these 28 teams will have increased their payroll either to get back to the playoffs or get in after being in thick of playoff contention the year before.

What was the effect of the increase in payroll on these 28 teams?

Of those teams, 14 won 88 or more games again after increasing their payroll; the other 14 failed to repeat their success> Again, it seemed that the increase in payroll had no overall effect on a team’s ability to repeat its success.

Conclusion

I’m obligated to point out that this entire study was based on a fairly small sample. Also most of the discussion was on the aggregate.

Obviously, as I showed, some teams did improve a good deal after “going for it” and breaking the bank the next season. At the same time, many teams did not improve but instead regressed despite a much larger overall budget.

I wouldn’t conclude based on these results that “any large increase in payroll, even if it means adding impact talent, does not change anything on the field.”

Instead, my real point is that an increase in payroll does not guarantee results.

Even after adding Albert Pujols, C.J. Wilson and Zack Greinke (in mid-year) last season, the Angels failed to make the playoffs. The Tigers added a ton of talent in 2008, but all was for naught.

No matter how great a team’s offseason may seem, it really means nothing until games are played on the actual field.

References & Resources

All contract and payroll information comes from the wonderful compensation tables at Baseball Prospectus.

Any chance on some sort of plot graph showing correlation (if there even is one)?

Thanks for the comment, Ryan. I do have a scatter plot, but I felt it didn’t add much to the piece. For one, why would there be a linear relationship between higher and higher percent increases and higher win totals?

The scatter plot is exactly that, extremely scattered, although I did find a weak positive correlation (r= 0.19) between percent increase and change in win total. The slope of this very weak regression indicated that a one percent increase in payroll only resulted in .14 more wins in the next season.

A couple of thoughts:

1. Is there a more long-term effect of increasing the payroll? Sometimes the first year is a bust but if they stick with an elevated payroll are years 2 and 3 better? You would think they would do better than teams that drop payroll, at least.

2. Teams don’t go for broke to win more games but to make the playoffs. Wins is a secondary consideration. Take a team that realistically has, say, a 1% chance of making the playoffs. If going for broke increases their chances to 25% but on average will end up with a worse record than the year before, that may seem a worthwhile risk. An analysis of playoff accomplishments and “near misses” (fell short by a few games) would be more illuminating.

Isn’t this kind of the short of it:

Going for broke is only as good a strategy as the players you spend the money on turn out to be

I think considering why teams’ payrolls are rising would aid the analysis of whether “going for broke” is effective. Some teams may invest heavily in new talent, and you would expect that most of them would improve.

However, many teams invest more money in order to reward good performance and retain players. If a team does well enough to substantially increase payroll, it’s more likely to be an outlier, and that would make a decline the following season statistically likely.